Imagine wrapping up the financial year with zero stress, knowing every record is perfectly in place and compliant. Sounds too good to be true? It is not – if you start preparing now.

As the end of financial year (EOFY) approaches, your accounts payable (AP) team is kicking into high gear, making sure every financial record is accurate and compliant with regulations. A time of year that can be a bit nerve-wracking for both management and staff, but getting the details right now will provide peace of mind, help with accurate budget planning, and enable smart decisions for the coming year.

For AP, it is crucial for businesses to know exactly what records are needed and to make accurate, complete record-keeping a part of everyday operations. You will need to prepare a summary of income and expenses, including employee travel and expense payments, along with GST, superannuation, and PAYG withholding statements for the full financial year, as required by the Australian Taxation Office (ATO). Keeping up with record-keeping requirements and building thorough processes into your workflows will make things a lot easier when it is time to submit your financial figures to the ATO and undergo your annual audit.

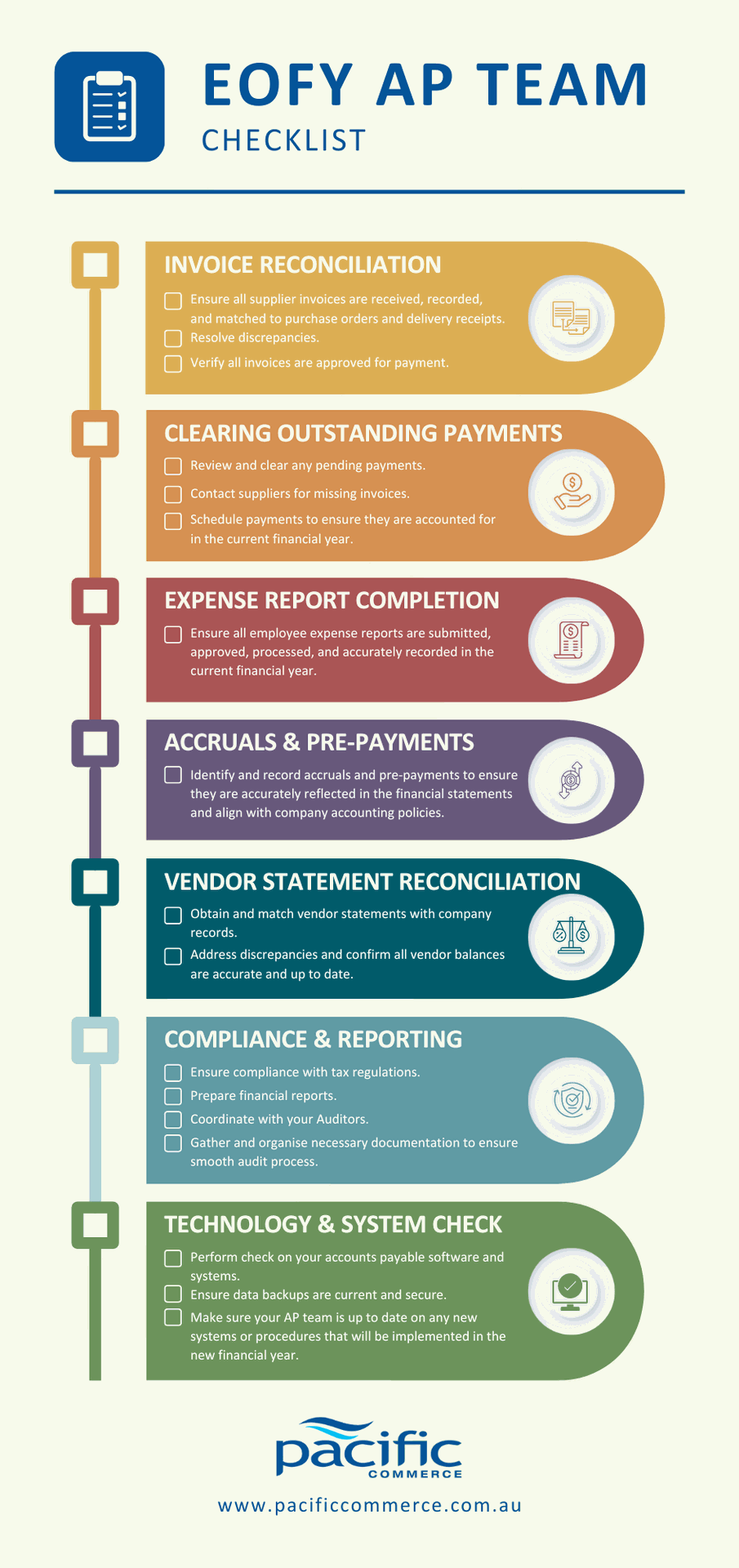

To help your team navigate this busy time efficiently and with as little stress as possible, we have put together an EOFY checklist. Think of it as a roadmap to guide your AP team through the critical tasks that need to be completed. It will help you avoid missed deadlines, minimise errors, and ensure compliance with financial regulations.

Your EOFY checklist:

Invoice Reconciliation

Ensure all supplier invoices are received, recorded, and matched to purchase orders and delivery receipts.

Resolve discrepancies.

Verify all invoices are approved for payment.

Clearing outstanding payments

Review and clear any pending payments.

Contact suppliers for missing invoices.

Schedule payments to ensure they are accounted for in the current financial year.

Expense report completion

Ensure all employee expense reports are submitted, approved, processed, and accurately recorded in the current financial year.

Accruals & pre-payments

Identify and record accruals and prepayments to ensure they are accurately reflected in the financial statements and align with company accounting policies.

Vendor statement reconciliation

Obtain and match vendor statements with company records.

Address discrepancies and confirm all vendor balances are accurate and up to date.

Compliance & reporting

Ensure compliance with tax regulations.

Prepare financial reports.

Coordinate with your Auditors.

Gather and organise necessary documentation to ensure smooth audit process.

Technology & systems check

Perform check on your accounts payable software and systems.

Ensure data backups are current and secure.

Make sure your AP team is up to date on any new systems or procedures that will be implemented in the new financial year

Final tips

- Begin your EOFY preparations well in advance to avoid last-minute rushes and errors.

- Keep lines of communication open with your team, suppliers, and other departments to ensure everyone is aligned.

- Regularly review your checklist and progress to ensure all tasks are on track.

- Maintain organised records and documentation to facilitate a smooth EOFY process and audit.

By following this EOFY checklist, AP teams can ensure a thorough and efficient closure of the financial year, paving the way for a successful and organised start to the new financial year.

Right click > save image below to download the EOFY AP team checklist infographic for easy reference.